amazon flex tax forms uk

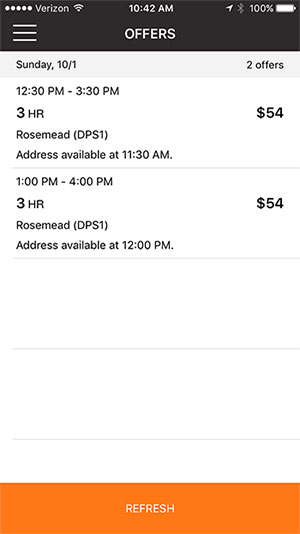

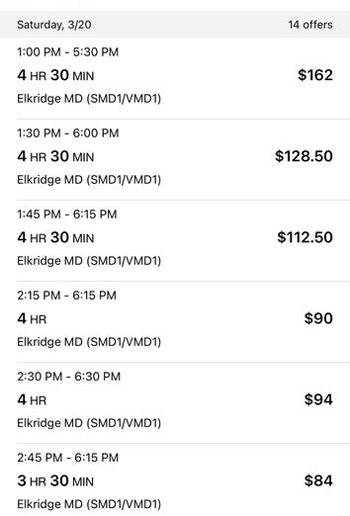

Actual earnings will depend on your location any tips you receive how long it takes you. Service income to US.

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Keeper helps you to.

. Aquí nos gustaría mostrarte una descripción pero el sitio web que estás mirando no lo permite. Amazon will send you a 1099 tax form stating your taxable income for the year. I order AMAZON FLEX LIMITED and Som Bahadur Bishwakarma jointly and severally liable to pay AMAZON EUROPE CORE SÀ RL.

This is a newer form thats now used in place of the old Form 1099-MISC. 410 Terry Avenue North Seattle WA. Get your 1099-NEC from Amazon Flex.

You can apply for the Amazon Flex Debit Card 2 on the Rewards Details page in Your Dashboard of the Amazon Flex app. How do you get your Amazon Flex 1099 tax form. Internal Revenue Service regulations your Amazon Flex 1099 form download to be available by January 31st.

You can find your Form 1099-NEC in Amazon Tax Central. Obviously I dont know what your income is so only you will know whether this is the case or not. With Amazon Flex you deliver parcels with your own car at times that suit you - you can choose to deliver as little or as often as you like.

Or download the Amazon Flex app. Op 5 yr. A few basic hints and tips for registering as self employed sole trader and information on when and how to file your tax return.

But if including your Flex income takes your OVERALL income full time job Flex over 50K for the year then youll be taxed at the higher rate - 40. Gig Economy Masters Course. This is a community for Amazon Flex delivery partners based in the UK only.

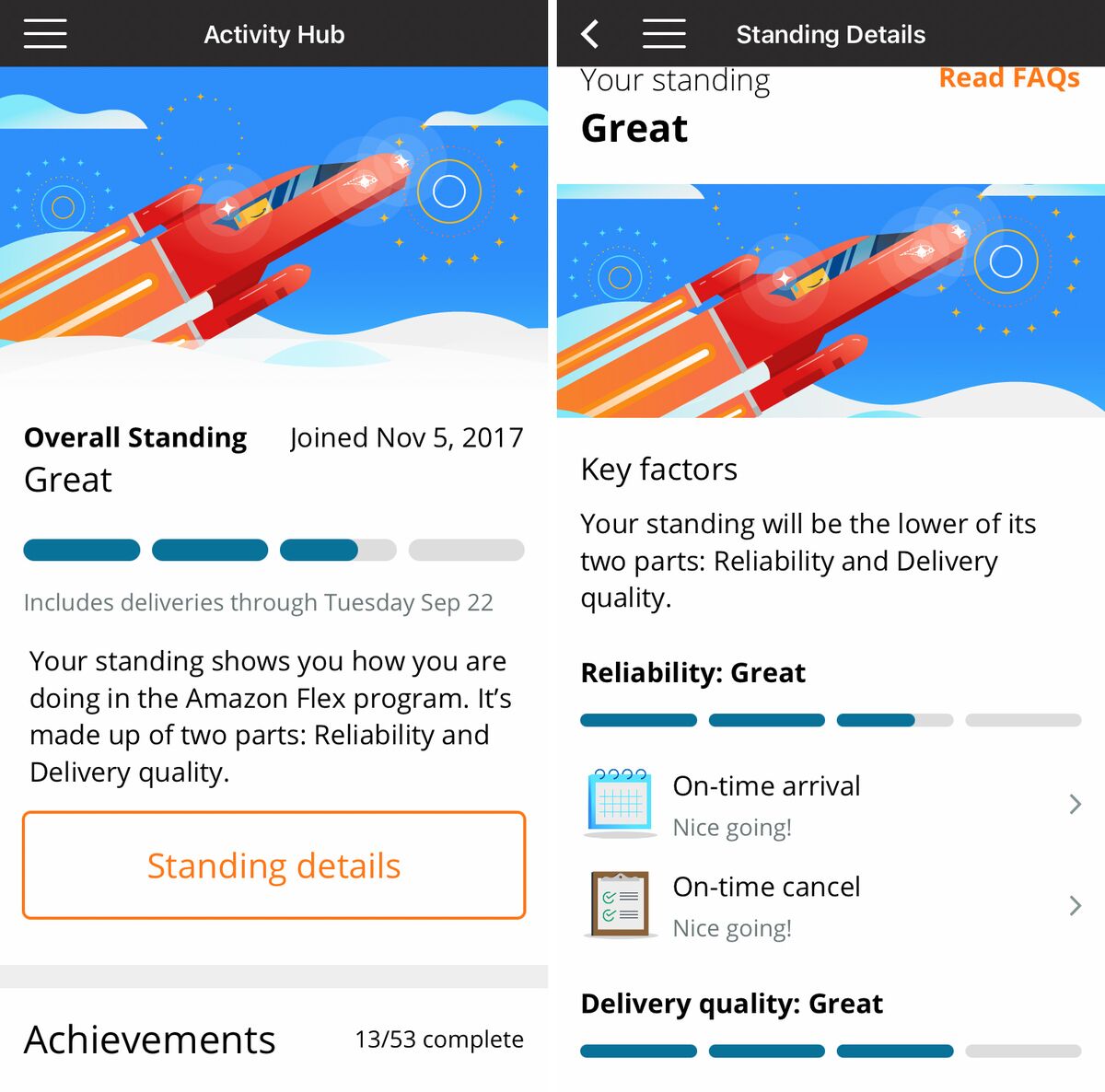

This is rather a broad topic and Ive tried to touch on the. Form 1099-NEC reports the annual income you earned from an independent contracting gig like driving for Amazon. No matter what your goal is Amazon Flex helps you get there.

Go to the Amazon Flex App Menu Your Dashboard Rewards Details. Contribute to kenong00project08 development by creating an account on GitHub. All you need is a smartphone a valid UK drivers licence and to be 18 or older.

NEC stands for nonemployee compensation. Discover short videos related to amazon flex tax return uk on TikTok. Are you making money by driving for Amazon Flex.

Alternatively you can call the Amazon Flex Support Helpline at 44 8081 453 757 daily between 0900 and 2100 for any questions related to the Amazon Flex programme the app or any account related concerns. You are required to sign your completed Form W-9. A few basic hints and tips for registering as self employed sole trader and information on when and how to file your tax returnThis is rather a broad topi.

This is the non-employee compensation 1099 form you receive from Amazon Flex if you earn at least 600 with them if it is under 600 you will not receive the form -- but still have to report the income otherwise youll receive filing penalties. Watch popular content from the following creators. When you sign-up and apply via the app you will be guided through the registration process before selecting where you want to.

If you are a US. Most drivers earn 18-25 an hour. The NEC stands for nonemployee compensation and it distinguishes this form from other types of 1099s all of which are used to report various kinds of income.

Tap the Amazon Flex Debit Card application button. Form 1099-NEC is used to report nonemployee compensation eg. This sub really has an abundance of UK drivers the post didnt go down very well.

Payee and received nonemployee compensation totaling 600 or more Amazon is required to provide you a 1099-NEC form as well as report these amounts to the IRS. According to Keeper Tax Amazon will send both you and the IRS a 1099-NEC form if you make more than 600 in a tax year. Form 1099-NEC is replacing the use of Form 1099-MISC.

This is the only thing I can think of as to why youre being asked to pay 3000 in tax. For payment questions please report the issue via the Earnings tab in. Yeah as far as I can tell you can fill our your assessment online and include relevant expenses milage while youre deliveringgoing to and from the depot which will not be taxed only the profit you make.

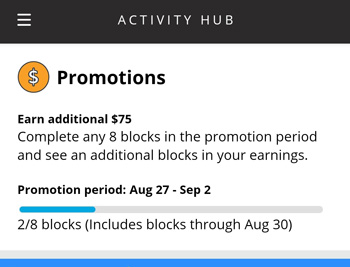

Increase Your Earnings.

Amazon Flex Support How To Easily Contact Amazon Customer Service

How To Become An Amazon Flex Driver In Australia

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Amazon Amzn Is Using Gig Economy Drivers To Deliver From Malls Bloomberg

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Amazon Officially Launches New State Of The Art Fulfillment Center In Clay Business Wire

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Fired By Bot Amazon Turns To Machine Managers And Workers Are Losing Out Bloomberg

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Amazon Enters Gig Economy With Uber For Packages Service Amazon The Guardian

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Account Deactivated For No Reason How Do I Appeal And What To Say To Get Reactivated R Amazonflexdrivers

An Amazon Flex Delivery Driver In His 60s Making 120 A Day Shares What It S Like To Work Independently For The Retail Giant Warehouse Automation

How To Do Taxes For Amazon Flex Youtube

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Amazon Flex Mileage Tracking Explained Triplog

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable